Gift, debt, or assistance: what to write in the payment purpose to avoid penalties.

08.06.2025

3688

Journalist

Shostal Oleksandr

08.06.2025

3688

In 2025, Ukrainians actively use card transfers for financial assistance to relatives, repaying debts, and personal transactions. However, even a regular transfer can raise the bank's suspicions or attract the attention of the State Tax Service due to incorrectly stated payment purpose. Financial consultants warn: it is important to formulate the purpose of the transfer correctly to avoid account blockages, tax audits, and penalties. Every card transaction is recorded by banks, so regulatory authorities can check its content.

Transfers from relatives: how to do it correctly

The tax service will not impose taxation on transfers from close relatives of the first and second degree of kinship, but it is important to clearly specify the nature and purpose of the transfer to avoid suspicions from the bank.Recommended formulations: - Gift from mom for birthday; - Assistance from dad for education; - Financial support from husband for studies; - Financial support from son for education.

Compensation for shared expenses requires detailing

When sharing costs with friends or relatives, it is important to detail the transfer clearly, avoiding generalizations.Safe formulations include: - Compensation for expenses for a shared dinner at the 'XXX' restaurant; - Refund for movie tickets for the film 'Title'; - Share for food order via Glovo on 04.06.2025.

Sale of personal items: emphasis on non-commercial nature

When selling personal items, it is important to emphasize their non-commercial nature, as the legislation does not contain a clear provision for tax exemption of these incomes.- Refund for used iPhone 12 (personal use); - Settlement for personal equipment - Samsung TV.

What to avoid in the payment purpose

Lawyers advise avoiding formulations like 'payment for services', 'settlement for the order', 'salary' or 'compensation' without the status of an individual entrepreneur.An empty purpose field should also be avoided, as it may lead to bank monitoring.

What to do in case of incorrect registration

If the payment purpose is indicated incorrectly, experts recommend contacting the bank for correction, preparing documents to confirm the true nature of the transfer, and being ready to explain its origin in case of a tax audit.'Clear, truthful, and specific formulation in the payment purpose field will help avoid misunderstandings with the bank and tax authorities,' experts summarize.Correctly formulating the payment purpose helps avoid troubles when making card transfers. Properly indicating the transfer's purpose helps to avoid tax issues and account blockages, so it is advisable to follow financial experts' recommendations on formulating the payment purpose.

Read also

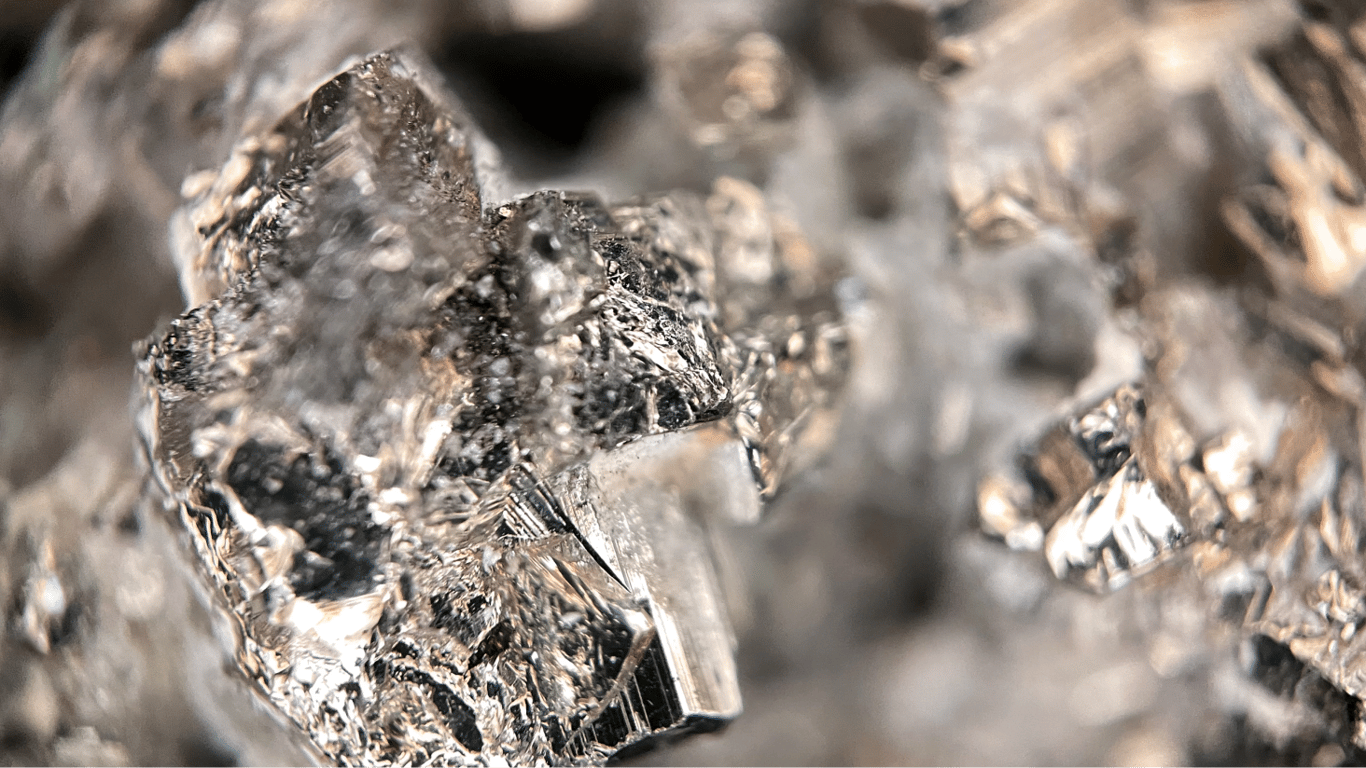

- Strategic Resource — How Many Gas Fields Are in Ukraine

- Minus 20 billion UAH — Hetmancev explained why the budget is losing money

- Lithium Reserves of 490 Million Tons — What Valuable Metal Has Been Found in China

- Salary and Financial Assistance - What You Need to Know About Payments to Police Officers

- Housing in the capital has become more expensive — why buying has become easier

- Leaders of minerals - which metal is most abundant in Ukraine