Property Tax - Hetmancev explained what hinders its imposition.

Property tax is a local tax that is fully credited to the local budget. However, without reliable information about the properties, their owners, and areas, it is impossible to accurately calculate the tax. The property registries in Ukraine are in extremely unsatisfactory condition, complicating the administration of this tax.

Danilo Hetmancev, head of the Verkhovna Rada's Committee on Finance, Taxation and Customs Policy, emphasized that the property tax in Ukraine is the most poorly administered. Often, properties are not included in the databases or have been entered with errors, complicating the process.

Problems with the property tax

In addition to issues with registries, there are several other factors that make the property tax less effective:

- Uneven administration;

- Lack of informational campaigns;

- Difficulty in verifying data;

- Absence of penalties for late payment.

For the property tax to be effective, it is important to have up-to-date and reliable registries. This tax is an important source of income for local budgets and a tool for social justice.

The Ukrainian property registries are in extremely unsatisfactory condition, complicating the imposition of property tax. The lack of data on properties and their owners creates problems with administration, which may lead to a loss of income for local budgets.

Read also

- The Ministry of Education canceled the order regarding distance learning - what does it mean

- NATO Calls for Preparation for War with Russia and China

- The court has ruled on the case of the detained KMDAs official on bribery charges

- Serhii Kryvonos in an exclusive interview for Novyny.LIVE

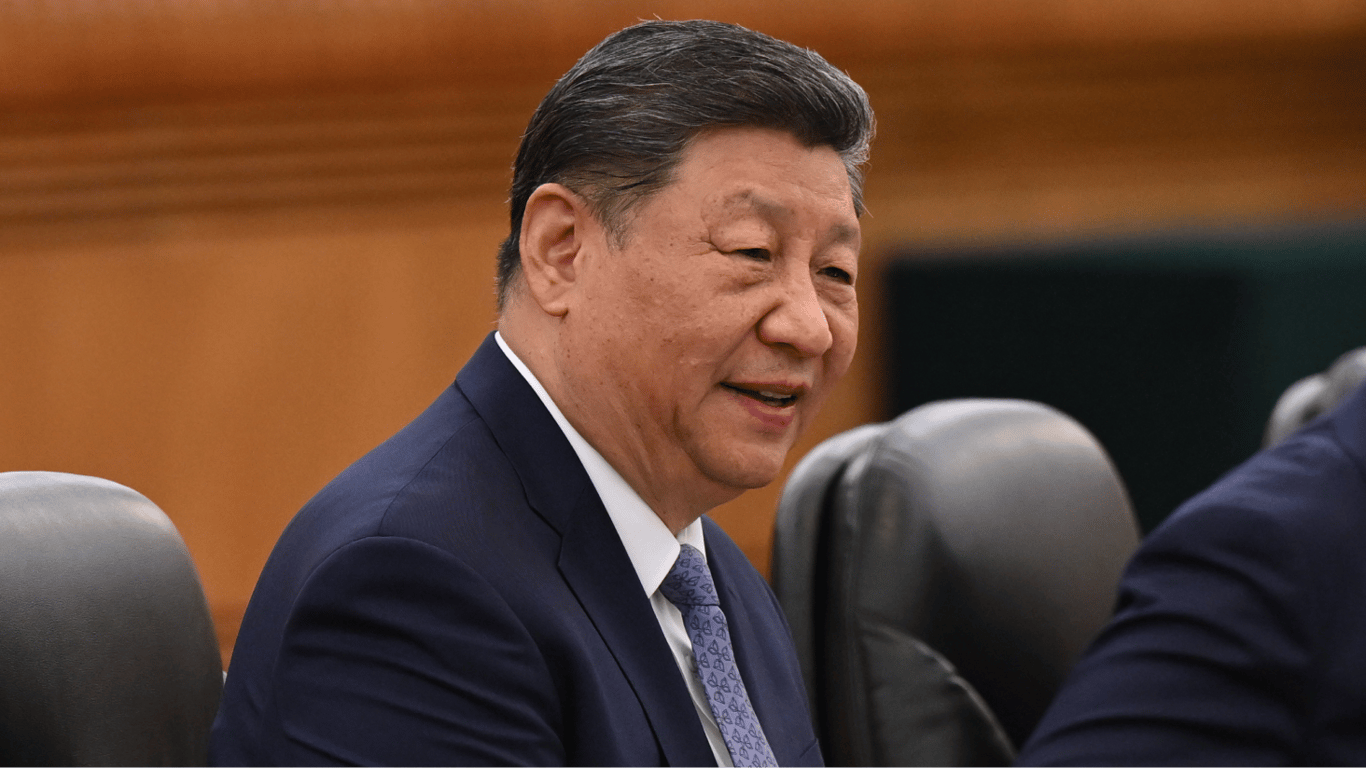

- Xi Jinping plans to organize a meeting with Trump and Putin

- Sadovyi said why Russia needs the remains of Kuznetsov and Putin from Lviv